How to Choose the Right Business Structure

Main Section 1

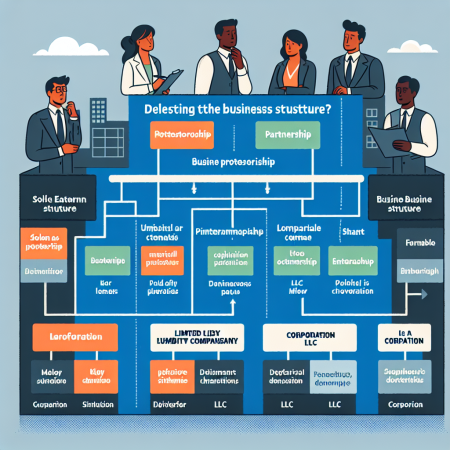

Subsection 1: When choosing a business structure, one of the key factors to consider is liability protection. Understanding the level of personal liability you are willing to undertake is crucial. A sole proprietorship means that you are personally liable for all business debts, while forming a corporation or limited liability company (LLC) can offer you limited liability protection.

Subsection 2: Tax implications are another vital aspect to evaluate when selecting a business structure. Each type of entity is taxed differently, so it’s essential to consider how the structure will affect your tax obligations. For instance, a sole proprietorship doesn’t separate business income from personal income, while an S-corporation allows pass-through taxation.

Subsection 3: The complexity of running the business also plays a role in determining the appropriate structure. Sole proprietorships are straightforward to set up, but they offer minimal separation between personal and business assets. On the other hand, corporations involve more formalities, such as holding regular board meetings and keeping detailed records.

Subsection 4: Future growth and exit strategies should not be overlooked. If you plan to seek investors or go public in the future, a corporate structure might be more suitable due to its ability to issue stock. Conversely, if you prefer a simpler structure with fewer regulations, an LLC could be a better fit.

Main Section 2

Subsection 1: Flexibility in management is a critical factor that can influence your decision. Depending on the structure you choose, you may have different levels of control and decision-making power. For example, in a partnership, decisions are typically shared among partners, whereas in a sole proprietorship, you have full control.

Subsection 2: Consider the costs associated with setting up and maintaining each type of business entity. Some structures require more paperwork, fees, and ongoing compliance compared to others. It’s essential to weigh these costs against the benefits and resources available to your business.

Subsection 3: Your industry and business goals can also guide you in selecting the right structure. Certain structures are more common or advantageous in specific industries. For instance, professional service firms often opt for a limited liability partnership (LLP) due to its liability protections tailored for professional practices.

Subsection 4: Evaluating the level of formality required in your business operations is important. If you prefer a more informal structure with fewer regulations and reporting requirements, a sole proprietorship or partnership might be suitable. Conversely, if you want a structured environment with clear roles and responsibilities, a corporation could be more appropriate.

Main Section 3

Subsection 1: Understanding how the chosen business structure affects ownership and control is crucial. Different structures provide varying degrees of ownership rights and control over the business. For example, shareholders in a corporation have voting rights based on the number of shares they hold.

Subsection 2: The ability to raise capital is another consideration. Some business structures make it easier to attract investors or secure loans due to their perceived stability and legal structure. If you plan to expand or need funding, you should choose a structure that aligns with your capital-raising goals.

Subsection 3: Succession planning is an essential aspect that should not be overlooked. Depending on the structure you choose, transferring ownership or management of the business to others may have different legal implications. It’s important to consider how you envision the future of your business in terms of ownership transition.

Subsection 4: If you prioritize maintaining privacy and confidentiality, the choice of business structure is significant. Certain structures, such as sole proprietorships, disclose less information to the public compared to corporations, which may have more stringent reporting requirements that expose details about the business.

Main Section 4

Subsection 1: Compliance requirements and regulations vary depending on the business structure you choose. Some entities are subject to more extensive reporting and compliance obligations, such as filing annual reports or holding regular meetings. Understanding these requirements is essential to avoid penalties or legal issues.

Subsection 2: Consider the impact of the business structure on your personal finances and credit. Certain structures may affect your personal credit score or ability to obtain financing. Separating personal and business finances can be more challenging in some structures, potentially putting your personal assets at risk.

Subsection 3: The geographic location of your business can also influence the choice of structure. Different states have varying regulations and tax implications for each type of entity. It’s advisable to consider the specific laws and requirements in your state before finalizing your decision on the business structure.

Subsection 4: Lastly, risk management strategies should be taken into account when choosing a business structure. Assessing the level of risk associated with your industry and operations can help determine the most suitable structure for protecting your personal assets and minimizing liabilities.

Main Section 5

Subsection 1: Seek professional advice from attorneys, accountants, or business advisors when deciding on the most appropriate business structure for your venture. These experts can provide valuable insights and help you navigate the legal and financial considerations involved in each structure.

Subsection 2: Consider the long-term implications of your decision. Changing business structures in the future can be complex and costly, so it’s crucial to plan ahead and select a structure that aligns with your current and future business goals.

Subsection 3: Conduct a thorough analysis of the advantages and disadvantages of each business structure based on your specific circumstances. What works well for one business may not be ideal for another, so tailor your choice to fit your unique needs and ambitions.

Subsection 4: Remember that no business structure is set in stone. As your business grows and evolves, you may need to reassess and potentially change the structure to better accommodate new opportunities or challenges that arise along the way.