How to Secure Funding for Your Startup

Research Funding Options

Before diving into the world of startup funding, it’s crucial to research and understand the various options available. One common avenue is venture capital (VC) funding, where investors provide capital in exchange for equity in the company. Another option is angel investors, who are individuals willing to invest their own money in promising startups. Additionally, crowdfunding platforms like Kickstarter and Indiegogo have become popular for raising funds from a large pool of individuals.

Government grants and loans are also viable options for certain startups, especially those involved in research and development or socially impactful projects. It’s essential to explore all possible avenues and consider which funding source aligns best with your startup’s goals and long-term vision.

Assess Your Funding Needs

One crucial aspect of securing funding for your startup is determining how much capital you actually need. Calculating your funding requirements involves analyzing your budget, operational costs, projected growth, and potential risks. By understanding your financial needs, you can approach investors with a clear and realistic funding ask, increasing your chances of securing the required capital.

Moreover, identifying the specific areas where funding will be allocated helps demonstrate a strategic approach to investors. Whether it’s product development, marketing, hiring key team members, or scaling operations, having a detailed breakdown of how the funds will be utilized showcases your business acumen and vision.

Build a Strong Network

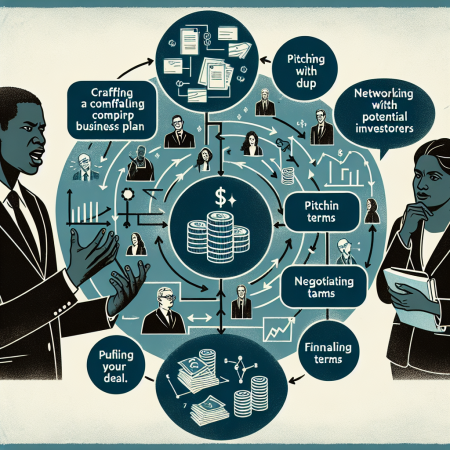

Networking plays a crucial role in securing funding for your startup. Building relationships with potential investors, mentors, industry experts, and other entrepreneurs can open doors to funding opportunities. Attend networking events, join startup accelerators, and engage with online communities to expand your network and access valuable resources.

Establishing a strong network not only increases your visibility within the startup ecosystem but also provides opportunities for mentorship, advice, and introductions to key stakeholders. Leveraging your network can significantly impact your ability to secure funding and propel your startup to success.

Prepare a Compelling Pitch

When approaching potential investors, having a compelling pitch is essential to capture their interest and convey the value proposition of your startup. Your pitch should clearly articulate your unique selling points, market opportunity, competitive advantage, and financial projections. Craft a story that resonates with investors and highlights the potential for growth and profitability.

Practice and refine your pitch to communicate your vision effectively in a concise and engaging manner. Consider creating a pitch deck that showcases key information visually and provides a clear overview of your business model and growth strategy. A well-prepared pitch can make a lasting impression on investors and increase the likelihood of securing funding.

Due Diligence and Legal Considerations

Before finalizing any funding agreements, conduct thorough due diligence on potential investors and understand the terms and conditions of the investment. Seek legal advice to ensure that the terms are fair and aligned with your startup’s interests. It’s essential to have a clear understanding of the equity stake, rights, obligations, and potential exit scenarios associated with the funding.

Protecting your startup’s interests through well-crafted legal agreements is crucial for long-term success. Consult with legal professionals specialized in startup funding to navigate the complexities of investment agreements and safeguard your business from potential risks or disputes down the road.